ACH Bank Transfers: Easy Guide to Electronic Payments\n\n## What Exactly Are ACH Bank Transfers?\n\nAlright, guys, let’s dive into

ACH bank transfers

! Ever wondered how your paycheck magically lands in your account every two weeks, or how you pay that utility bill without writing a single check? Chances are, you’ve experienced the magic of an

ACH transfer

. ACH stands for the

Automated Clearing House

, and it’s a super important electronic network that facilitates billions of financial transactions every year right here in the U.S. Think of it as the silent, efficient workhorse of our modern banking system. Instead of moving physical cash or paper checks, ACH moves

electronic files

between banks. These files contain instructions for financial transactions, allowing funds to be debited or credited from accounts. It’s a reliable, secure, and incredibly cost-effective way to move money, making it a cornerstone for businesses and individuals alike.\n\n

Understanding ACH bank transfers

is crucial in today’s digital economy because they power so much of our financial lives. From your direct deposit paycheck to those automated bill payments, even peer-to-peer apps often rely on the ACH network in the background to shuttle your funds. Unlike wire transfers, which are typically for high-value, immediate transfers, ACH transactions are batched and processed in groups, usually over a few business days. This batch processing is one of the reasons they are so much more affordable. The network is governed by NACHA (National Automated Clearing House Association) rules, which ensure consistency, security, and proper handling of all transactions. For anyone looking to streamline their finances, whether personal or business, getting a grip on ACH is incredibly valuable. It’s not just about convenience; it’s about leveraging a robust infrastructure designed for efficiency and reliability. So, when we talk about

ACH bank transfers

, we’re really talking about a fundamental piece of the puzzle that keeps our economy moving smoothly without the old-school hassle of paper. We’ll explore the nitty-gritty details of how they actually work, the benefits they offer, and how you can make the most of this fantastic electronic payment system. Stay tuned, because this information is gold for anyone who wants to understand how money truly moves in the digital age.\n\n## How Do ACH Transfers Work Behind the Scenes?\n\nEver wondered about the

behind-the-scenes

mechanics of

ACH bank transfers

? It might seem like magic when money moves electronically, but there’s a well-oiled process at play. Let’s break it down in a friendly way. Imagine you’re setting up a recurring bill payment for your gym membership. You authorize the gym (the

Originator

) to pull funds directly from your bank account. Here’s how that instruction travels: First, your gym sends the payment request to its bank, known as the

Originating Depository Financial Institution (ODFI)

. This ODFI collects all the payment requests from its clients, bundles them into a large batch file, and then sends that file to the central hub, the

ACH Network

. This network, operated by the Federal Reserve and The Clearing House, acts like a massive digital sorting facility. It processes these batches, sorting individual payments and routing them to the correct receiving banks.\n\nOnce the ACH Network sorts the payment, it sends the request to your bank, which is called the

Receiving Depository Financial Institution (RDFI)

. Your RDFI then receives the instruction to debit your account for the gym membership fee. This process isn’t instant; it typically takes 1-3 business days for the funds to fully settle. There are two main types of

ACH bank transfers

to know about:

ACH debits

and

ACH credits

. An

ACH debit

is when money is pulled

from

your account, like your gym membership fee or a monthly utility bill. An

ACH credit

, on the other hand, is when money is pushed

into

your account, such as your direct deposit paycheck or a tax refund. The beauty of this system lies in its

batch processing

: banks don’t send individual messages for every single transaction. Instead, they gather thousands of transactions and send them together in large files, usually overnight. This batching is what makes ACH so incredibly efficient and cost-effective compared to other payment methods. It reduces the overhead per transaction significantly. NACHA’s rules dictate the timing, format, and responsibilities of all parties involved, ensuring that your money is handled securely and correctly throughout the entire journey. So, next time your direct deposit hits, remember the complex yet seamless dance of the ODFI, ACH Network, and RDFI making it all happen! It’s a testament to the power of structured electronic communication in finance.\n\n## The Awesome Benefits of Using ACH Transfers\n\nAlright, guys, let’s talk about why

ACH bank transfers

are such a superstar in the world of electronic payments. The benefits are pretty significant, making them a preferred choice for individuals and businesses alike. First up, and probably the biggest draw, is their

cost-effectiveness

. Compared to other methods like wire transfers or even paper checks, ACH transactions are generally much cheaper, often just a few cents per transaction. This low cost is a huge advantage, especially for businesses processing a high volume of payments, saving them a ton of money over time. For you, it means your utility company isn’t tacking on extra fees just to process your automatic payment.\n\nNext, we’ve got

reliability and security

. The

ACH network

is incredibly robust and has been around for decades, operating under strict NACHA rules. These rules are designed to ensure data protection, fraud prevention, and overall system integrity. Your financial information is transmitted securely, often encrypted, and there are dispute resolution processes in place if something goes wrong. This makes ACH a very trustworthy way to move your money. Think about it: no lost checks in the mail, no worry about someone forging your signature. It’s all digital and tracked. Another massive benefit is

automation and convenience

. For individuals, setting up direct deposit or recurring bill payments means you never have to worry about missing a payment or rushing to the bank. Your money just goes where it needs to go, automatically. For businesses, this translates to reduced administrative tasks, fewer manual errors, and predictable cash flow. Imagine not having to print, sign, and mail hundreds of paychecks every payday – that’s the power of automated

ACH bank transfers

.\n\nWhile not instantaneous like a wire transfer, ACH offers a

good balance of speed and cost

. Most transactions settle within 1 to 3 business days, which is perfectly acceptable for recurring payments, payroll, or mass payouts. Plus, recent advancements like Same Day ACH have made it even faster for urgent payments, giving businesses and consumers more flexibility. Finally, let’s not forget the

environmental perk

. By going paperless, ACH transactions significantly reduce the need for paper checks, envelopes, and transportation, contributing to a greener planet. It’s a win-win-win: cost-effective, secure, convenient, reasonably fast, and environmentally friendly. For anyone looking to modernize their financial operations or simply simplify their personal banking, embracing

ACH bank transfers

is a no-brainer. They truly represent a leap forward in how we manage and move our money, providing tangible value and efficiency in our daily financial lives.\n\n## ACH vs. Wire Transfers: What’s the Big Diff, Guys?\n\nOkay, so we’ve talked a lot about

ACH bank transfers

, but what about their cousin, the wire transfer? Many people confuse the two, but guys, there are some pretty

significant differences

you need to know. Understanding these distinctions is crucial for choosing the right payment method for your specific needs. The main keywords here are

speed, cost, irrevocability,

and

typical use cases

. Let’s break it down.\n\nFirst, let’s talk about

speed

. This is perhaps the most glaring difference.

Wire transfers

are designed for speed. When you send a wire, the funds are typically moved almost instantaneously, often within a few hours, sometimes even minutes, if both banks are part of the same real-time network. This makes them ideal for time-sensitive transactions, like closing on a house or making an urgent international payment.

ACH bank transfers

, on the other hand, are processed in batches. They usually take 1 to 3 business days to fully settle, though Same Day ACH has sped up some transactions. So, if you need money to arrive

right now

, a wire is your go-to; if a day or two is fine, ACH is your friend.\n\nNext up is

cost

. This is where

ACH bank transfers

really shine. ACH payments are incredibly inexpensive, often costing just a few cents or even being free for consumers (like direct deposit). This low cost is due to the batch processing system we discussed earlier.

Wire transfers

, however, are typically much more expensive. Banks often charge a flat fee ranging from

\(15 to \)

50 (or more for international wires) per transaction. This higher cost reflects the immediate, one-off nature of wires and the direct, immediate routing of funds. So, for recurring, high-volume, or non-urgent payments, ACH is the clear winner on price.\n\nThen there’s

irrevocability

. This is a critical point for security and risk management. Once a

wire transfer

is sent, it’s generally considered

irrevocable

. This means that once the funds are sent and received by the beneficiary bank, it’s incredibly difficult, if not impossible, to get them back. This characteristic makes wires a prime target for fraudsters, as unauthorized transfers are hard to reverse.

ACH bank transfers

, while still secure, offer a bit more flexibility in terms of disputes and reversals. Under NACHA rules, there are provisions for returning unauthorized or erroneous transactions within a certain timeframe (usually 60 days for consumers). This added layer of protection can be very reassuring.\n\nFinally, let’s look at

typical use cases

.

Wire transfers

are best for large, high-value, urgent, or one-off payments, especially internationally, where immediate settlement is paramount. Think real estate closings, large business-to-business transactions, or emergency funds.

ACH bank transfers

are perfect for routine, recurring, lower-value payments like payroll, bill payments, direct deposits, P2P transfers, and business-to-business invoicing that doesn’t require immediate settlement. Essentially, if it’s automated and happens regularly, it’s likely an ACH. If it’s a one-time, urgent, big-money move, it’s probably a wire. Understanding these differences empowers you to make smarter financial decisions, ensuring your money moves the way you need it to, securely and efficiently.\n\n## Common Use Cases for ACH Payments in Your Daily Life\n\nGuys,

ACH bank transfers

are so ingrained in our daily financial routines that you probably use them constantly without even realizing it! They truly are the unsung heroes of electronic payments. Let’s look at some of the

most common use cases

where you’ll encounter and benefit from the efficiency of the

ACH network

.\n\nFirst up, and arguably the most widespread, is

payroll and direct deposit

. This is a massive one for almost everyone who works. Instead of receiving a physical check that you then have to take to the bank, your employer uses

ACH bank transfers

to send your net pay directly into your bank account. It’s incredibly convenient, reliable, and ensures you get access to your funds quickly on payday. For businesses, direct deposit through ACH dramatically reduces administrative costs associated with printing, distributing, and reconciling paper checks. It’s a win-win for both employees and employers, making payday a seamless experience.\n\nNext, think about all those monthly bills:

utilities, rent, mortgage, insurance premiums, loan payments

. Many of us set these up for

recurring bill payments

. These automated deductions are almost always powered by

ACH bank transfers

. You authorize the service provider (your electricity company, your landlord, your bank) to debit your account on a specific date each month. This means no more stamps, no more remembering due dates, and no more late fees. It’s a fantastic way to manage your finances and ensure your obligations are met without manual intervention. The convenience factor here is immense, freeing up your mental energy for more important things.\n\nBeyond regular bills,

ACH bank transfers

are also fundamental to many

peer-to-peer (P2P) payment apps

like Venmo, Zelle, and PayPal. While these apps offer instant user-to-user transfers on the surface, the underlying movement of funds between different banks often relies on the ACH network for the final settlement. When you transfer money from your P2P app balance to your bank account, or vice-versa, that’s typically an ACH transaction. This demonstrates how versatile the network is, supporting both direct corporate-to-consumer payments and more personal financial interactions, albeit sometimes in the background.\n\nFor businesses,

ACH bank transfers

are essential for

business-to-business (B2B) payments

and managing vendor payments. Companies can efficiently pay suppliers, contractors, and other partners directly from their bank accounts. This not only streamlines the payment process but also improves cash flow management, reconciliation, and reduces the risk of fraud associated with paper checks. It’s a modern, efficient way for businesses to handle their outgoing expenses. Similarly, businesses use ACH for

customer payments

, allowing them to collect subscription fees, installment payments, or even one-time purchases directly from customer accounts, assuming proper authorization. From government benefits and tax refunds to investment contributions and online purchases, the reach of

ACH bank transfers

is extensive. They simplify, secure, and speed up countless financial interactions, proving their indispensable role in our modern, connected world.\n\n## Getting Started with ACH: Tips for Individuals and Businesses\n\nAlright, guys, now that you know how awesome

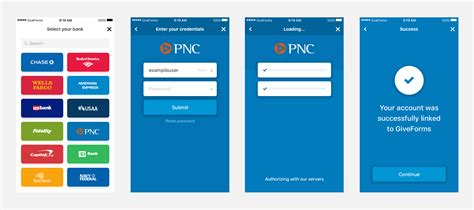

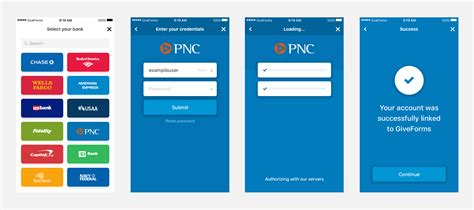

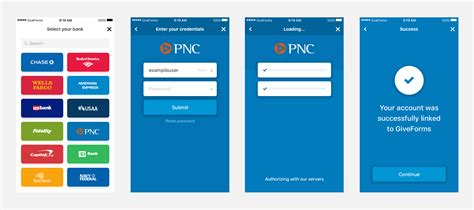

ACH bank transfers

are, let’s talk about how you can actually

get started

using them effectively, whether you’re an individual looking to streamline your personal finances or a business aiming to optimize your payment processes. It’s easier than you might think, and the benefits are well worth it!\n\nFor

individuals

, the most common entry point for

ACH bank transfers

is through

direct deposit

and

recurring bill payments

. To set up direct deposit for your paycheck, your employer will typically provide you with a form. You’ll need to provide your bank account number and your bank’s routing number. These two pieces of information are the keys to ensuring your funds land in the correct account via the ACH network. Most banks make it super easy to find your routing number on your checks or through your online banking portal. Once set up, your pay will automatically hit your account on payday, saving you a trip to the bank and giving you immediate access to your money. Similarly, for recurring bill payments (like your mortgage, utilities, or insurance), you’ll usually authorize the biller directly. They’ll ask for your bank account and routing numbers. Always make sure you’re setting these up through

trusted and secure portals

or directly with the service provider to protect your financial information.

Always double-check the details

before authorizing any debit from your account! You want to ensure the right amount is going to the right place. These simple steps can profoundly simplify your personal financial management, reducing stress and avoiding late fees.\n\nFor

businesses

, leveraging

ACH bank transfers

opens up a whole new world of efficiency. The first step usually involves choosing an ACH payment processor or integrating with your existing bank’s business services. You’ll need to apply and get approved to originate ACH transactions. When selecting a processor, look for one that offers robust security features, easy integration with your accounting software, competitive pricing, and excellent customer support. Once set up, you can start processing direct deposits for employees, collecting recurring customer payments (like subscriptions or memberships), and paying vendors electronically. For collecting payments, you’ll need to obtain

proper authorization

from your customers – typically a signed agreement or an electronic consent form. This is a critical step for compliance with NACHA rules and to avoid unauthorized transactions. Remember, for

ACH bank transfers

, especially debits, having clear authorization is non-negotiable. Businesses should also be mindful of

return rates

and

NACHA compliance

. High return rates can lead to fines or even suspension from the ACH network. Staying informed about the latest NACHA rules and implementing strong internal controls for payment processing are vital. By embracing ACH, businesses can significantly reduce operational costs, improve cash flow predictability, and enhance customer satisfaction through convenient payment options. It’s a smart move for any business looking to modernize its financial toolkit.\n\n## A Quick Look at ACH Security and Regulations\n\nWhen we talk about

ACH bank transfers

, it’s natural to wonder about security. After all, we’re talking about your hard-earned money moving around electronically! The good news, guys, is that the

ACH network

is designed with robust security and operates under a comprehensive set of regulations, primarily dictated by

NACHA (National Automated Clearing House Association)

rules. These rules are the backbone of the system, ensuring that all participants – banks, businesses, and consumers – adhere to strict standards for processing and protecting financial information. This isn’t some Wild West of electronic payments; it’s a highly regulated and secure environment.\n\nOne of the foundational aspects of

ACH security

is the requirement for

proper authorization

. For any ACH debit (where money is pulled from your account), the originating party

must

have your explicit permission. This can be a signed paper authorization, a voice recording, or an electronic agreement. Without valid authorization, an ACH debit can be disputed and reversed. This gives consumers a significant layer of protection against unauthorized transactions. NACHA rules also mandate that participants implement strong data protection measures. This includes using

encryption

for data in transit and at rest, maintaining secure systems to prevent unauthorized access, and implementing fraud detection and prevention protocols. Banks and ACH originators are required to protect sensitive information, like account numbers, from breaches.\n\nFurthermore, the

ACH network

has mechanisms in place for

error resolution and returns

. If an unauthorized

ACH bank transfer

occurs, or if there’s an error (like a wrong amount or duplicate payment), consumers typically have up to 60 days from the settlement date to dispute it with their bank. Businesses have shorter timeframes, usually 2 to 5 banking days, for certain types of returns. These return codes and procedures are standardized across the network, ensuring a consistent approach to resolving issues. This ability to reverse erroneous transactions provides a crucial safety net, especially when compared to the irrevocability of wire transfers. Beyond NACHA, financial institutions involved in

ACH bank transfers

are also subject to various other banking regulations, including those from the Federal Reserve, the CFPB (Consumer Financial Protection Bureau), and other government bodies. These layers of oversight and regulation further strengthen the security and integrity of the ACH system. So, while no system is 100% immune to all risks, the

ACH network

has a long-standing track record of being a highly secure and reliable method for electronic payments, continually adapting its rules and technologies to protect users and maintain trust in our digital financial ecosystem.\n\n## The Future of ACH: What’s Next for Electronic Payments?\n\nAlright, guys, we’ve covered a lot about

ACH bank transfers

, from how they work to their benefits and security. But what does the future hold for this incredible electronic payment system? The truth is, the

ACH network

isn’t sitting still; it’s constantly evolving, driven by technological advancements and the increasing demand for faster, more seamless financial transactions. The future of ACH is all about

speed, integration,

and

expanded capabilities

.\n\nOne of the biggest recent developments, and a sign of things to come, is

Same Day ACH

. While traditional ACH transfers could take 1-3 business days, Same Day ACH, introduced in phases since 2016, allows for faster processing of both credits and debits, with settlement occurring on the same business day. This has been a game-changer for many businesses and individuals, enabling quicker payroll, faster bill payments, and more immediate access to funds. The expansion of Same Day ACH capabilities, including increased dollar limits and longer processing windows, points to a clear trend: the ACH network is striving to meet the growing need for speed without sacrificing its inherent cost-effectiveness and reliability. This push towards faster settlement highlights the network’s adaptability and commitment to staying relevant in a rapidly accelerating financial landscape.\n\nBeyond Same Day ACH, the broader conversation in the payments industry revolves around

real-time payments (RTP)

. While ACH is near real-time with Same Day capabilities, true RTP systems, like the RTP® network from The Clearing House and the Federal Reserve’s FedNow® Service, offer instant, irrevocable, 24/7/365 settlement. So, what does this mean for

ACH bank transfers

? It doesn’t mean ACH is going away! Instead, we’ll likely see a future where ACH and RTP coexist and even complement each other. ACH will continue to be the workhorse for recurring, high-volume, cost-sensitive payments like payroll and automated bill pay, where a few hours or a day of settlement time is perfectly acceptable. RTP will cater to urgent, immediate, and perhaps lower-volume, higher-value transfers where instant availability is paramount. We might see more

integration

between these systems, with ACH payments potentially leveraging aspects of RTP for certain components, or vice versa, to offer hybrid solutions.\n\nFurthermore, expect continued focus on enhanced

data capabilities and fraud prevention

within the

ACH network

. As technology advances, so do the methods of fraudsters. NACHA and participating financial institutions are always working to bolster security measures, improve authentication processes, and leverage AI and machine learning for more sophisticated fraud detection. The evolution of

ACH bank transfers

will also involve greater

interoperability

with other payment types and platforms, making it even easier for businesses and consumers to initiate and receive payments across various channels. Ultimately, the future of ACH is bright, characterized by continuous innovation aimed at providing more flexibility, speed, and intelligence to keep pace with the dynamic demands of our digital economy. It’s an exciting time to be involved in electronic payments!